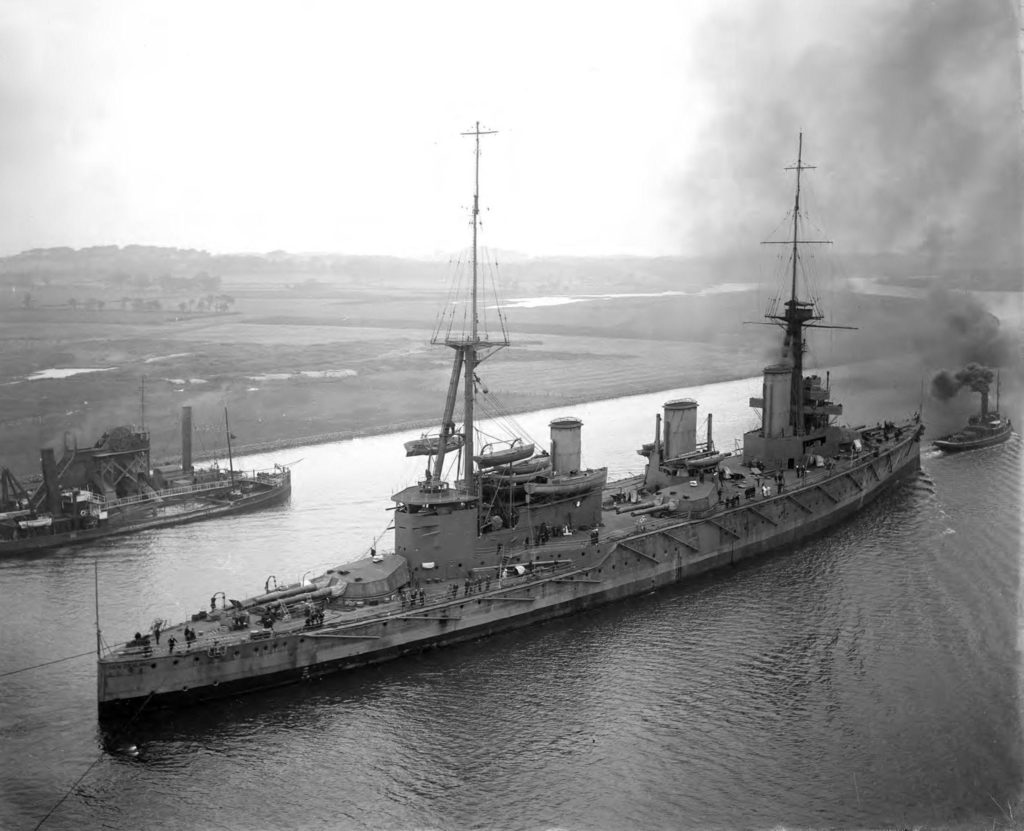

One of the many mythologies surrounding the battlecruiser HMS New Zealand – the gift that the New Zealand government made to Britain in April 1909 – is that she was unaffordable. According to legend, New Zealand was too small to afford her, had no money and the ship therefore had to be paid for by a loan. This direct ‘loan’, the story goes, was never paid off until 1944-45, some 20-odd years after the last pieces of the battlecruiser were cut up for scrap.[1]

Like all myths, these ideas have due basis in truth – money was indeed borrowed, and the last ledger entries for the battlecruiser were not struck off the books until the 1944-45 fiscal year. But the reality surrounding these events is very different from the supposition that a single ‘loan’ was involved, or that the country could not afford either the ship, or to repay it. At the time the gift was made, the Governor, Lord Plunkett, made point of noting to his masters in Britain that the New Zealand government seemed little concerned about how they could pay for the ship. Nor were they. Here’s why.

The offer of March 1909 was for a ‘first class’ battleship – and, if necessary, a second. Specifics were undefined, but the ballpark figure for such a vessel was about £2,000,000 at the time. This figure, however, was not large against the scale of the New Zealand economy. While GDP figures were not collected at the time, economists (former colleagues of mine, in fact) have been able to reverse-engineer this from other data, and have published carefully calculated estimates.[2] In 1909, when the gift was made, New Zealand’s nominal GDP – meaning ‘in period values’ – was about £102,000,000, on an economy growing at about 4.8 percent per annum.[3] The cost of the gift, therefore, amounted to 1.96 percent of annual GDP in 1909, at a time when that GDP was climbing quickly – making that cost, of course, proportionately ever-smaller in later years.

The more crucial figure was the scale of government cash-flows. Governments the world over – then and now – paid for capital projects by raising loans and using government cash-flow to incrementally pay those back, typically over a 25-30 year period for any specific loan, but sometimes longer. The New Zealand government had been paying for large public works this way for decades by 1909: not just the railway system but also to prop up local body expenses on infrastructure, to which were added special projects such as the Westport harbour works, which were crucial to national coal production. Legislation authorised government agents to borrow up to certain maximums, and the money was raised incrementally over time to the legislated limit, usually on the London financial markets. What this meant was that amounts authorised for state works were disconnected from specific borrowings, and the whole became an exercise in ledger-keeping. This same system was applied to the gift battlecruiser.

The Naval Defence Act 1909 authorised borrowings of up to two million pounds for the gift battlecruiser. However the only money directly raised under this Act for the ship was a temporary loan of £459,500, at four percent interest, to pay for initial expenses in 1910-11 – including around £190,000 for armour.[4] This was wholly repaid in 1912 and the figure swallowed in a new £4.5 million authorisation to borrow. That was in part to pay off the temporary loan and fund remaining payments on the ship; but also intended to consolidate £2,840,500 of other government borrowings.[5]

All this, in short, was an exercise in ledger entries and book-keeping. That was further underscored by the fact that the ship was charged to New Zealand incrementally, down to small sums for deck fittings – an excruciating paper trail from Fairfield, the ship’s builders, to the Admiralty, then the New Zealand High Commission in London, and finally the desk of the Minister of Defence in New Zealand. Payments went on through the 1910-11 and 1913-14 financial years, with a final sum in 1914-15 – grand total £1,698,152, six shillings and sixpence in actual hardware costs. This was the true cost of the ship – down to the last sixpence. However, to this was added redemption costs attached to that earlier loan, plus the costs of raising new loans within the ambit of the 1912 authorisation, bringing the total accounted against the ship to £1,795,169, 4 shillings and 11 pence.

So how did this impact the national debt? New Zealand’s net total public debt on 31 March 1910 – before money was raised for the ship – stood at £73,387,420.[6] In modern terms, that made the national debt-to-GDP ratio about 75, which we can compare, for instance, with the US debt-to-GDP ratio of 128.1 in December 2020.[7] It was, in short, not excessive. The ship increased the national debt by most of the accounted total – £1,795,169, 4 shillings and 11 pence – but this was only a small proportion of new borrowings during the construction period. In fact, 88.2 percent of the money borrowed by the New Zealand government between fiscal years 1909-10 and 1912-13 was for works other than the warship. In short, the cost of the battlecruiser was only a relatively small proportion of the sums sloshing about in New Zealand’s public purse at the time.

The better measure of affordability, however, is to consider cash-flows – for it was through these that the loans were paid for. This was the calculation made by the Ward cabinet at the time, and it’s clear the ship was a minimal expense in those terms.

In the 1909-10 financial year, before anything had been borrowed for HMS New Zealand, some 26.66 percent of New Zealand’s government revenue went into debt servicing and repayment. The added debt servicing cost attributable to HMS New Zealand by 1912-13 amounted to an additional 0.66 percent call on total government revenue as it stood in 1909-10. That was trivial, and was one reason why government officials weren’t worried. The other was that they also knew the economy was rising.

In the event, government revenues increased by 21.33 percent to the end of 1912-13, outstripping the added cost of supporting the battlecruiser costs.[8] Indeed, as a result of state income growth, total national debt servicing costs dropped to 24.51 percent of all government expenditure at the end of 1912-13 – and this in spite of ongoing borrowing between 1909-10 and 1912-13, of which sums the battlecruiser only made up 11.8 percent.[9]

In other words, New Zealand could easily afford the battlecruiser and the added cost to state cash flows was more than swallowed up in growing revenue. There was one difference, though, between HMS New Zealand and other public expenses. Because it was a ‘special’, government decided to establish a ‘sinking fund’ to cover the repayment. An additional sum – about 4 percent of the capital cost – was set aside annually from state cash flows and invested with the Public Trust office. The idea was that after a certain period the cost of the ship could be met, and meanwhile the Public Trust could re-lend the capital. Of course ‘repayment’ would consist of cancelling ledger-entries listed against the ship – it was disconnected from the programme of borrowing – but everything would balance off.

What actually followed, though, was very different. The financial shenanigans of the 1920s explain why the other myth about HMS New Zealand’s costs – that the ‘battlecruiser debt’ was not ‘repaid’ until 1944-45 – came about. It turns out this had nothing to do with affordability. We will pick that up in the next article. Meanwhile, for the story of the ship from political idea to scrapyard, my book on HMS New Zealand is published by Seaforth and by the USNI Press. Check it out.

Copyright © Matthew Wright 2022

[1] The scrapping process was finally completed in September 1924.

[2] I worked professionally in economic history at one point.

[3] Phil Briggs, ‘Looking at the numbers’, NZIER, Wellington 2003 (2016 update), p. 11. Figures from https://data1850.nz/

[4] AJHR 1913, Session I, B-06, ‘Financial statement (in Committee of Supply 6th August 1913) by the Minister of Finance, The Hon. James Allen, p. xxvii

[5] AJHR 1912, Session II, B-18H, ‘Prospectus of the £4,500,000 loan’ p. 1.

[6] Figures in New Zealand Yearbook 1913, https://www3.stats.govt.nz/New_Zealand_Official_Yearbooks/1913/NZOYB_1913.html.

[7] https://tradingeconomics.com/united-states/government-debt-to-gdp

[8] Calculated from https://www3.stats.govt.nz/New_Zealand_Official_Yearbooks/1913/NZOYB_1913.html.

[9] Calculated from ibid.